Uncategorized

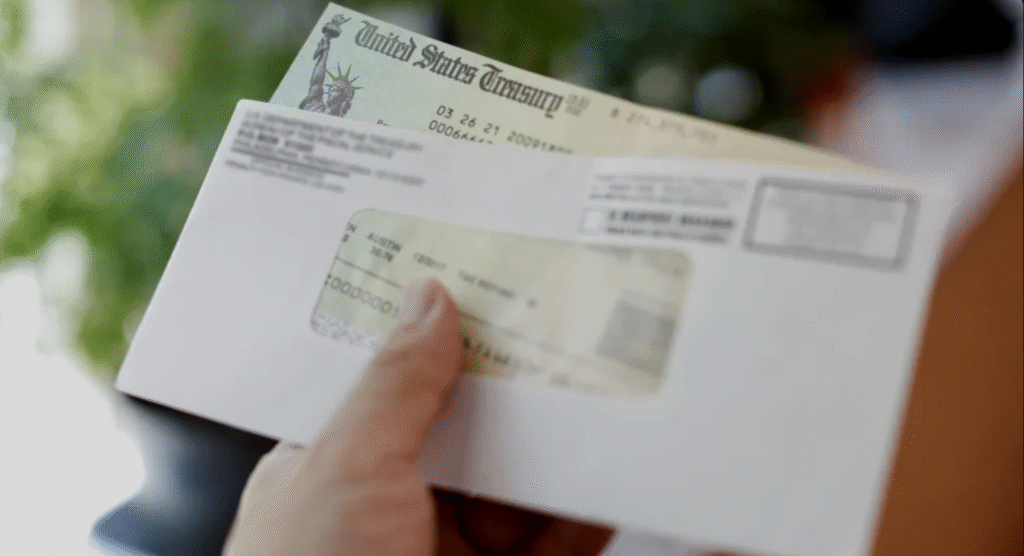

5 Best Ways To Use Your Stimulus Check If You Just Got Your $1,400 Payment

A stimulus check may seem like free money.

However, financial experts said how consumers use unexpected money can make a big difference in an uncertain economy.

Whether you’re catching up on bills, boosting retirement savings or paying down debt, here are the five best ways to use your stimulus check if you just got your $1,400.

Read Next: 3 Signs You’ve ‘Made It’ Financially, According to Financial Influencer Genesis Hinckley

Try This: The New Retirement Problem Boomers Are Facing

Boost Your Safety Net

Recipients should consider using their $1,400 stimulus check to build or replenish an emergency fund, especially if it’s currently underfunded. A solid cushion can help cover unexpected expenses like medical bills or job loss without relying on high-interest debt.

“The rule of thumb is to have enough money set aside to cover at least three months of your current expenses, but at a minimum you should have enough to cover your highest insurance deductible,” said financial coach Chris Fohlin.

“That’s usually a couple thousand dollars to cover you in any worst-case scenarios like a health emergency or car accident. If you don’t have enough in emergency savings, that’s where the entire check should go,” Fohlin explained.

Check Out: Are You Rich or Middle Class? 8 Ways To Tell That Go Beyond Your Paycheck

Tackle High-Interest Debt

Using the stimulus check to pay down credit cards or other high-interest loans can offer long-term financial relief. Reducing debt not only lowers monthly payments but also frees up cash for future needs or emergencies.

“Getting a windfall can seem like a great opportunity to just spend money or buy something fun. For many, using the money for something fun can make sense. But if you are behind on expenses or have high-interest debt, then you are missing out on a chance to get your finances under control,” said Ashley Morgan, bankruptcy and tax lawyer at Ashley F. Morgan Law.

“Using the $1,400 for any high-interest debt will help save you money in your monthly budget,” Morgan added.

Invest in the Future

For those who are financially stable, putting stimulus funds toward a Roth IRA or workplace retirement plan can help grow long-term wealth. Even small contributions can compound significantly over time, especially when invested early.

“I typically coach clients to make a rule that 15 to 25% of their income goes into retirement savings,” Fohlin said. “I had a client decide she would treat unexpected income differently and put 50% into retirement. The point is to create a playbook that factors in all your goals so there’s no guesswork around making smart money choices.”